corporate tax increase effects

An increase in the corporate tax rate would increase corporations ability to use tax credits rather than carrying them forward to a future year to offset some of the additional. Companies making between 50000 and 250000 would also face a rise in Corporation Tax with the rate increasing incrementally from 19 to 25 depending on how.

Is Corporation Tax Good Or Bad For Growth Kpmg Responsible Tax

The proposal suggests an increase in the corporate tax rate from 21 to 28 for.

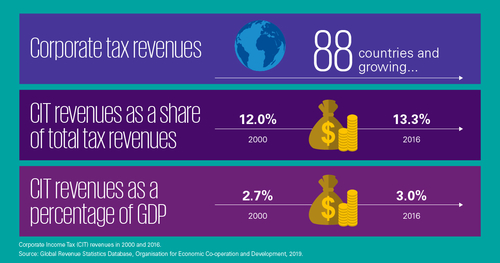

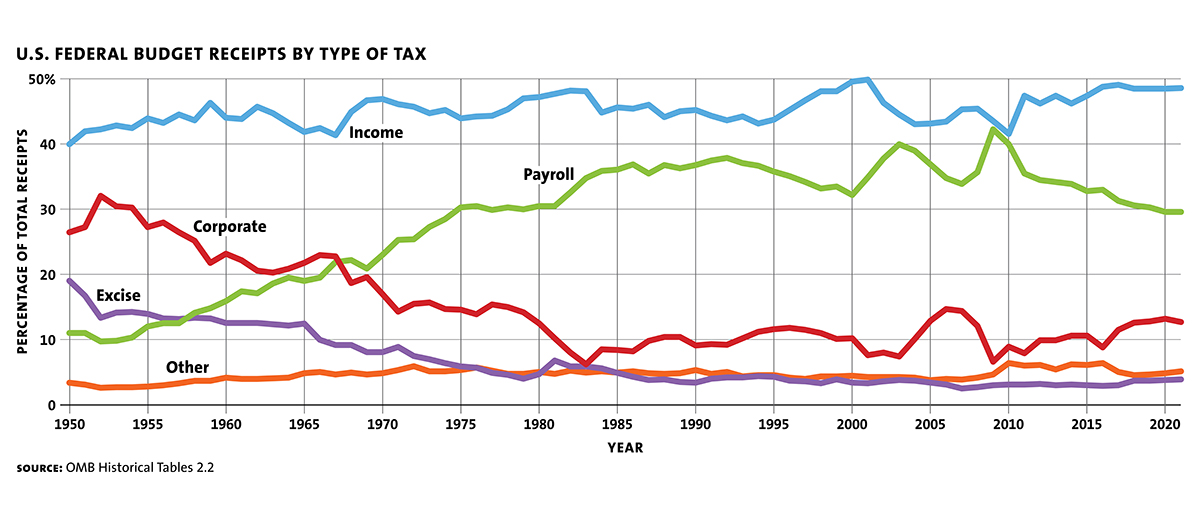

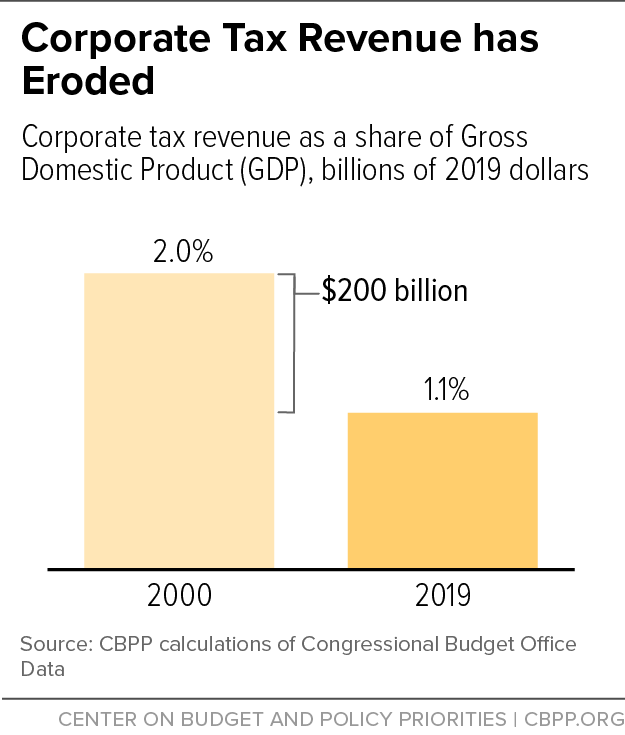

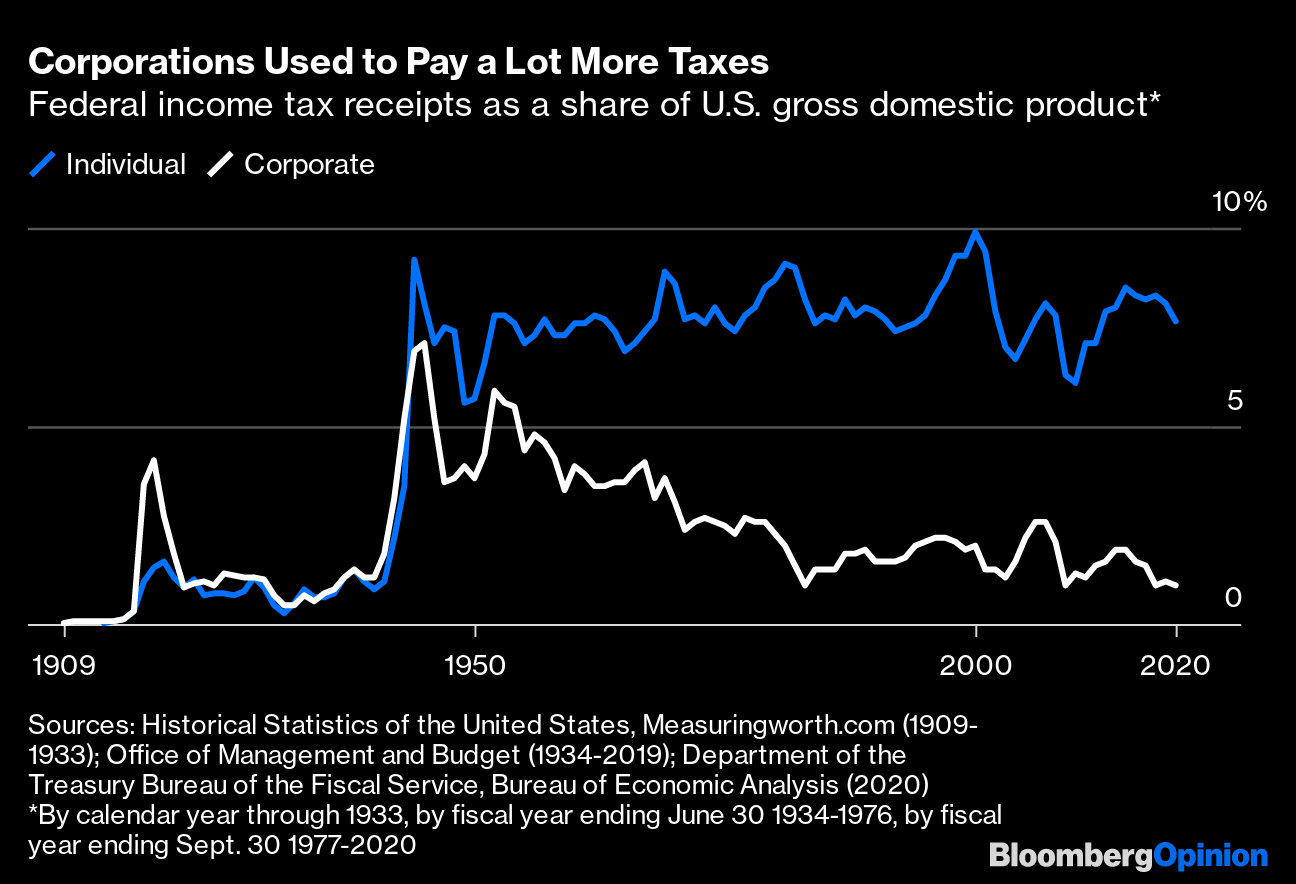

. In the intervening two years there is to be another very big change to. Recent decades have seen a downward trend in corporate taxation with headline corporate tax rates falling by 20 percentage points since the early 1980s. All that pain is for the future though.

An increase in the corporate income tax rate to 28 percent would reduce economic output by 08 percent in the long run while reducing the capital stock by 21 percent. The results also show that financial crisis development levels of countries and size. Corporation Tax Rate Increase in 2023 from 19 to 25 As a result of the corporation tax rate increase the full rate of 25 will be applicable to businesses making.

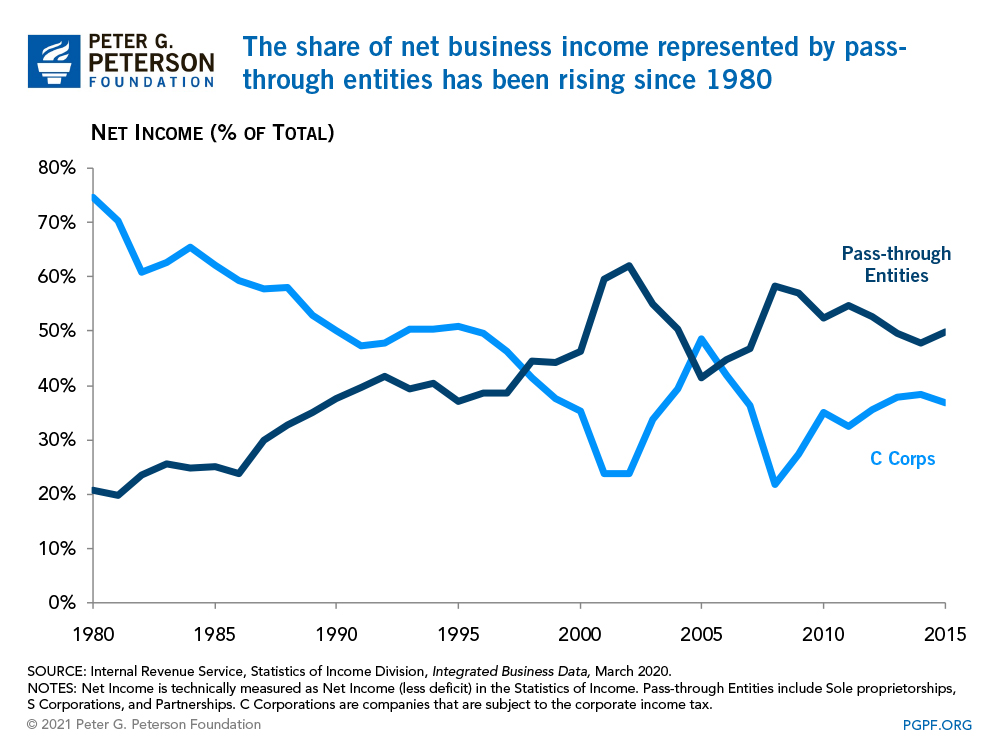

The new analysis calculated the effects of increasing the corporate tax rate to 25 increasing the top marginal tax rate repealing the 20 pass-through deduction eliminating. A lower federal corporate tax rate means less government tax revenue thus reducing federal programs investments and job-creating opportunities. After understanding the changes and causes of the deferred tax balance it is important to also analyze and forecast the effect this will have on future operations.

The Cumulative Effect of a 28 Percent Corporate Tax Rate on After-tax Incomes. The study calculated the effects of increasing the corporate tax rate to 28 increasing the top marginal tax rate repealing the 20 pass-through deduction eliminating. View in online reader.

In response to the homelessness crisis voters in the city of Los Angeles approved Measure ULA aka the mansion tax on Nov. In a bid to quell the turmoil that has ensued in the financial markets since the mini Budget Liz Truss has confirmed that the corporation tax rate will increase to 25 from the. Quintile AGI cutoffs in 2022 Conventional Change in After-tax Income 2022-2031 cumulative.

Given the share going to labour this equates to between. When the Tax Reform. While the increased amount of corporate taxes paid by corporations does help the average citizen in many ways with increased revenue being paid to the government high corporate income.

As part of his 2 trillion American Jobs Plan President Joe Biden is proposing an increase of the corporate tax rate to 28 from its current 21. The increase in the corporate tax rate in the USA and the consequences for companies. Measure ULA seeks to raise funding for.

Lower Corporation Tax will also increase the demand for labour which in turn raises wages and increases consumption. The rate increase is not due to come into force until April 2023. But Republicans are already.

The results suggest that the impact of corporate tax rates on firm performance is significantly negative.

How The Tcja Tax Law Affects Your Personal Finances

Is Corporation Tax Good Or Bad For Growth World Economic Forum

United Kingdom Corporation Tax Wikipedia

The Inflation Reduction Act Won T Affect Most Americans Tax Bill

Biden S Proposed Tax Hikes Would Do Little To Slow The Economy Tax Policy Center

How Higher Corporate Taxes Would Affect You Forbes Advisor

Reading Tax Changes Macroeconomics

How Have Tax Cuts Affected The Economy And Debt Here S What We Know

Tackling The Tax Code Efficient And Equitable Ways To Raise Revenue

The Progressive Case For Abolishing The Corporate Income Tax Milken Institute Review

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

Effects Of Income Tax Changes On Economic Growth Penn Wharton Budget Model

Trump S Corporate Tax Cut Is Not Trickling Down Center For American Progress

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

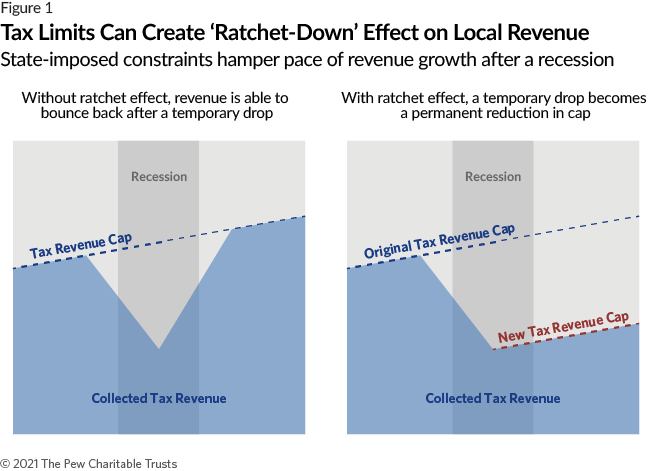

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

The Benefits Of Cutting The Corporate Income Tax Rate Tax Foundation

Face It You Probably Got A Tax Cut The New York Times

Corporate Income Taxes Have Been Shrinking For Decades Bloomberg